The Department of Government Efficiency (DOGE) is tasked with streamlining government operations, reducing wasteful spending, and improving overall efficiency within the federal government. Since its inception four months ago, DOGE has begun to reshape the government contracting landscape and the business of many federal vendors. The TechnoMile Research team, leveraging data from GovSearchAI, has created an analysis that measures the relative impact of DOGE activity on federal contractors.

Assessing DOGE Impact

When assessing the impact of DOGE activity, the TechnoMile Research team considers unexercised ceiling and options value, which represents the difference between the total potential value of a federal contract and the amount of work that has, to date, been ordered and funded by an agency and publicly reported – in simple terms, it’s contract value that is not yet realized and therefore could be at risk. Consequently, unexercised ceiling and options value provides a forward-looking indicator that allows us to “size up” the potential impact of DOGE initiatives on individual federal contractors, specific agencies, and categories of federal spend.

Summary of Analysis: Latest Wave of Consulting Contract Reviews

For this analysis, our team focused on the 9 vendors that have been asked to participate in the latest wave of consulting contract reviews by the General Services Administration (GSA). Recently, these firms received letters from Josh Gruenbaum, Federal Acquisition Service Commissioner, asking them to provide “detailed input on their contracts, broken down by agency and category of services,” as well as pricing information and ideas for identifying waste and savings opportunities. This is similar to the request the GSA made in late February, when contracts held by the top 10 consulting firms doing business with the federal government came under scrutiny.

As with the GSA’s February request, there is significant uncertainty regarding which contracts held by these firms will ultimately be deemed essential and how the GSA will assess the value that these firms’ contracts bring to federal operations. And, even where existing contracts are maintained, their contract value will likely change, as the GSA has been clear that it expects to be presented with discounted pricing as part of this review process. In Gruenbaum’s recent requests, he said, “All contracts that are deemed essential and recommended to continue following this review should be proactively restructured to be priced on an ‘outcome-based’ model.” In light of these ambiguities, our Research team declined to calculate TechnoMile’s proprietary DOGE Impact Score for each of the 9 impacted federal vendors and instead focused on a broader market analysis to answer these core questions:

- What is the unrealized value of federal contracts across the 9 firms included in the latest wave of scrutiny regarding consulting contracts?

- Who are the federal vendors impacted by this initiative and how much contract value is at risk for each?

- What types of work are these 9 firms performing for the U.S. government and what is the value of this at-risk work?

- Which agencies do these 9 firms support and how much contract value is at risk at each agency?

What is the unrealized value of the 9 impacted firms’ contracts?

The total unexercised ceiling + options value of the 9 impacted firms’ federal contracts is more than $16.1B.

Who are the impacted vendors and how much contract value is at risk for each?

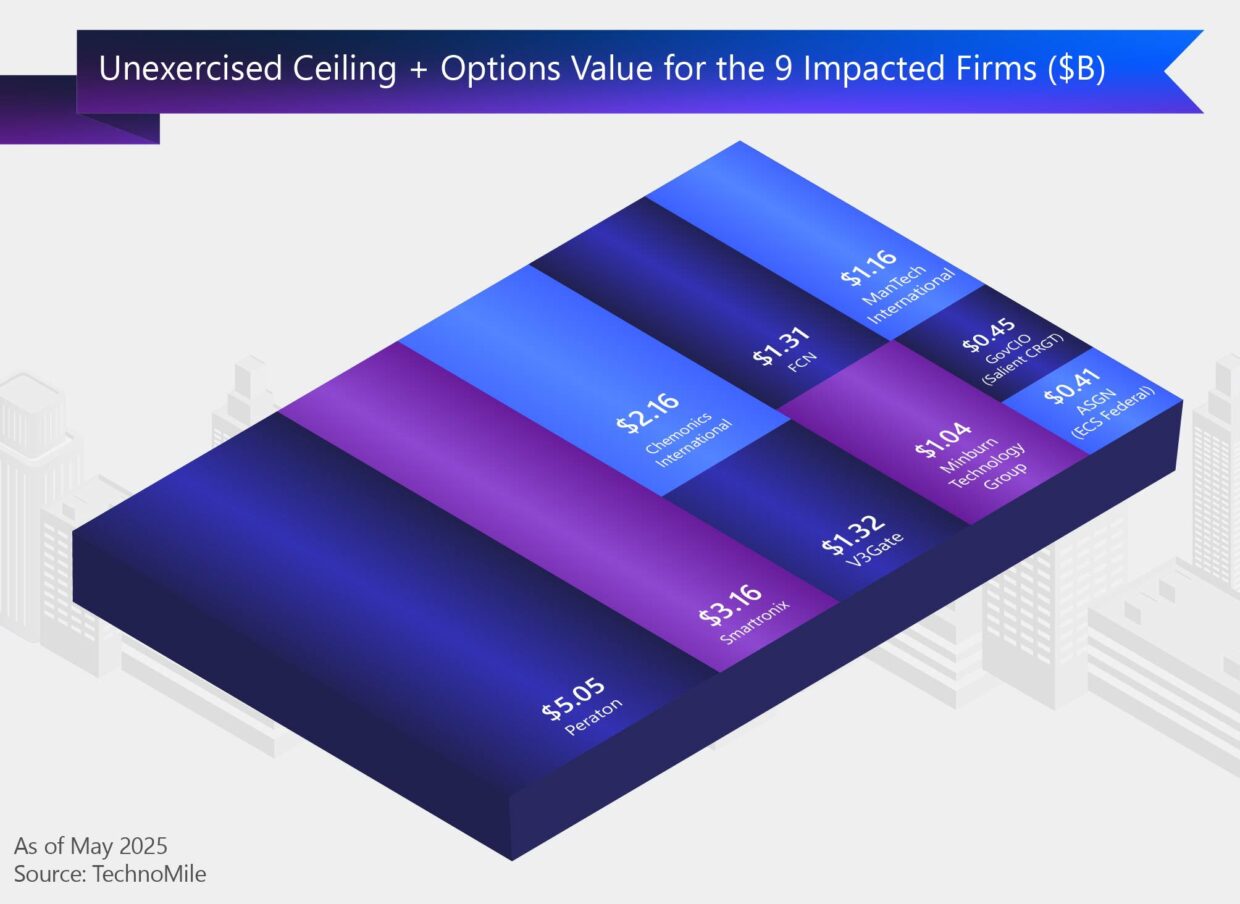

The image above includes the 9 impacted firms, along with the total unexercised ceiling + options value (in $ billions) of each vendor’s contracts across all federal agencies and categories of spend. This value represents each vendor’s maximum exposure, however significant uncertainty remains regarding the eventual impact of this GSA mandate – i.e., how much of this work will ultimately be identified as essential to federal operations and therefore be retained – and, if retained, how might the contract’s pricing be restructured?

This tree map visualizes the relative magnitude of at-risk contract value across the 9 impacted firms, with contracts held by Peraton and Smartronix comprising just over half (51%) of the unexercised ceiling + options value.

What types of work are these firms performing for the U.S. government and what is the value of this at-risk work?

The top five categories of federal spending among the 9 impacted firms comprise over 80% of the total unexercised ceiling + options value. These categories include:

- Application – $3.7B unexercised ceiling + options value (23% of total)

- Legal Services – $3.1B unexercised ceiling + options value (20% of total)

- Technical & Engineering Services – $2.2B unexercised ceiling + options value (14% of total)

- IT Outsourcing – $2.1B unexercised ceiling + options value (13% of total)

- Management & Advisory Services – $1.7B unexercised ceiling + options value (11% of total)

Additional categories with more than $100 million worth of unexercised ceiling + options value include:

- Network

- Technology Base

- Marketing & Public Relations

- Security and Compliance

- Data Center

- Business Administration

- End User

- IT Management

- Compute

- Systems Development

The image above visualizes the relative magnitude of at-risk contract value across the top 38 categories of federal spending among the 9 impacted firms (hover over the image and click to increase its size; hit escape to close the magnified image). Interested in seeing the vendor-specific details behind each category? Get a copy of the TechnoMile DOGE Impact Analysis: Latest Consulting Contract Reviews here.

Which agencies do the 9 impacted firms support and how much contract value is at risk at each agency?

This image visualizes the relative magnitude of at-risk contract value across the federal agencies served by the 9 impacted firms (hover over the image and click to increase its size; hit escape to close the magnified image). 50% of the at-risk contract value is made up of contracts with the Department of Defense and Department of Veterans Affairs.

Together, the top five agencies, based on at-risk contract value with the 9 impacted firms, make up 80% of the total unexercised ceiling + options value. These agencies include:

- Department of Defense – $5.8B unexercised ceiling + options value (36% of total)

- Department of Veterans Affairs – $2.2B unexercised ceiling + options value (14% of total)

- USAID – $1.9B unexercised ceiling + options value (12% of total)

- Department of the Treasury – $1.8B unexercised ceiling + options value (11% of total)

- NASA – $1.0B unexercised ceiling + options value (6% of total)

Key Takeaways

While DOGE’s focus on government efficiency and cost reduction has and will undoubtedly create new challenges for federal vendors, it can also create opportunities for those businesses that can adapt and innovate.

- New Efficiencies in B2G Companies – DOGE’s strong focus on cost efficiency could increase competition among federal contractors, necessitating that B2G organizations improve their own operational efficiency, including investment in back-office tools and technology used to win and manage federal contracts.

- Unlocking Innovation in B2G Companies – DOGE’s emphasis on modernization could cultivate even more innovation within organizations that do business with the government, and these cutting-edge strategies could result in a competitive advantage for vendors.

- Disruption in B2G Procurement Processes – DOGE’s initiatives could disrupt existing, often long-time relationships with agency personnel and require companies to adapt their business development and capture strategies and processes. Federal contractors need to be prepared for a wave of changes to procurement processes, agency POCs, contract requirements, and timelines.

Wrapping Up and Next Steps

TechnoMile, a veteran of the federal contracting community for over a decade, remains committed to supporting its customers and the broader industry as we navigate the current turbulent environment. While acknowledging the value of the DOGE initiative, TechnoMile emphasizes its dedication to providing members of the federal marketplace with essential data and insights to inform strategic decision making in this rapidly evolving landscape of government contracting.

If you’d like to receive a copy of the TechnoMile DOGE Impact Analysis: Latest Consulting Contract Reviews, click here.